Market Insights

2025: A year that turned Global Disruption into Domestic Resilience

24 Jan 2026

As the year draws to a close, it's instinctive to look back. History, on the other hand, is a bad motorist—it records every turn and collision, but it cannot steer us forward. Yet, it remains a valuable teacher, leaving behind signposts shaped by experience.

The year 2025 began amid global uncertainty with Donald Trump back in the global spotlight, and it concluded on a steadier note for India, with meaningful domestic reforms such as GST rationalization and interest rate cuts—quietly strengthening the foundation for the years ahead.

Trade Tensions & their ripple effects

In 2025, the U.S. imposed tariffs on Indian goods—starting at around 25% and later increasing to nearly 50% in August. Although these tariffs were imposed on only goods, not on services such as software and IT services, the move significantly impacted Indian exports.

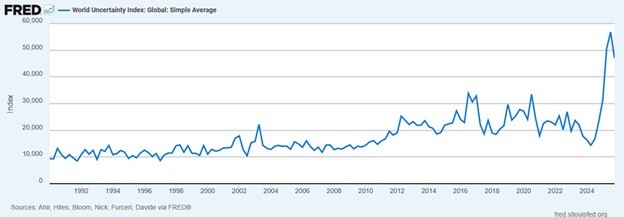

World Uncertainty Index: Global: Simple Average

The World Uncertainty Index (WUI) developed by the World Bank—an indicator tracking economic & political uncertainty across 143 countries—depicts the elevated global uncertainty in 2025, which often translates into policy unpredictability, market volatility, and slower growth.

A key contributor to this was the renewed global focus on the United States, particularly trade policy developments following Donald Trump’s return to prominence.

Turning Disruption into Strategy

Periods of global stress often test the true strength of an economy—not in how it reacts to shocks, but in how it adapts to them. The challenges of 2025 exposed vulnerabilities, but they also created an opportunity to reassess priorities and correct long-standing dependencies. Rather than relying on short-term fixes or reactive measures, India used this phase of disruption to strengthen its economic foundation. Its policy and markets steadily shifted from response to strategy. This transformation was evident across four key areas:

Venturing into New Export Markets

To reduce dependence on the U.S. and diversify its export markets, India accelerated its trade diplomacy in 2025. During the year

A comprehensive Economic Partnership Agreement (CEPA) was signed with Oman

A comprehensive trade agreement with UK was concluded in July 2025

A Free Trade Agreement was finalized with New Zealand

EU–India trade negotiations progressed steadily toward a potential agreement.

What initially looked disruptive turned out to be strategically beneficial for India.

Growing maturity and resilience of Indian capital markets

By 12 December 2025, net FII/FPI outflows touched ₹1,52,273 crore. Spread across 234 trading days, this translated to nearly ₹110 crore of selling every trading hour.

Despite this, 2025 did not resemble crisis years like 2008 or 2011–12. The reason was clear:

Indian markets were no longer fully dependent on foreign investors

Record mutual fund inflows of ₹4.84 lakh crore provided strong domestic support

Market volatility remained relatively contained despite sustained foreign selling

Structural Reforms for long-term growth

One of the most important developments was GST rationalization. India’s multiple GST slabs—0%, 5%, 12%, 18%, and 28%—have long added complexity to the tax system. The move to merge certain slabs, particularly 5% and 18%, aims to create a simpler, more transparent, and predictable tax system—one that supports long-term growth rather than short-term adjustments.

Supporting growth through monetary policy

To stimulate growth and ease borrowing costs, the RBI reduced the repo rate four times in 2025, cutting a cumulative 125 basis points over the year.

Date | Repo Rate Cut | Revised Repo Rate |

7-Feb-2025 | 25 basis points | 6.25% |

9-Apr-2025 | 25 basis points | 6.00% |

6-Jun-2025 | 50 basis points | 5.50% |

5-Dec-2025 | 25 basis points | 5.25% |

This cumulative reduction helped improve credit availability, even as it placed mild pressure on the rupee.

What the Signs Suggest

In a VUCA world—marked by volatility, uncertainty, complexity, and ambiguity, predicting the future remains challenging. However, certain signals offer guidance on what may lie ahead.

Positive Signs

GST rationalisation may improve efficiency and gradually lower costs

Lower interest rates are improving credit availability and supporting growth

Foreign investors may return as they seek diversification beyond AI-heavy markets

Reduced income tax burden (no tax up to ₹12 lakh) leaves more money in consumers’ hands, potentially boosting demand

Challenges Ahead

Free trade agreements with major economies like US & EU could increase competitive pressure on domestic industries

Global policy uncertainty, particularly from the U.S., may persist until late 2026

Conclusion

For investors, 2025 reinforced confidence rather than fear. Strong domestic participation, easing interest rates, and steady reforms have laid the groundwork for long-term investment environment.

Even as global uncertainties linger, India moves forward with deeper markets, resilient capital flows, and a policy framework that rewards patience, discipline, and long-term perspective.