September 2019 was an interesting month for the stock market. The month started on a volatile note with the Nifty falling nearly 300 points and then rallied furiously, gaining nearly 900 points in just two trading sessions on the back of the Corporate Tax cut announced by the Government.

October has begun on a sober note with the Nifty going back to levels seen at the beginning of September. This kind of market movement creates both hope and trepidation depending on the temperament of the investor. In this blog post, we will discuss the nature of market volatility and try to address some of the most frequently asked questions we get from mutual fund investors, e.g. is the right time to invest, should I remain invested in mutual funds etc.

Up and Downs are part of investment journey

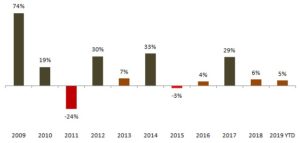

Many people who started investing in the last 5 years or so may be experiencing prolonged volatility and deep correction for the first time. Nifty 50 TRI has given nearly 10% CAGR returns over the last 10 years beating gold (8.8% CAGR) and FD (7.6% CAGR), but the journey was not smooth. The chart below shows the price movement of Nifty 50 TRI over the last 10 years.

If we see the annual returns of Nifty 50 TRI over the last 10 years, the market gave negative annual returns twice, 2011 and 2015. In 4 out of the last 10 years, the market gave unsatisfactory returns assuming you expect equity to beat fixed income returns which on average has been around 7%. Despite underperforming 60% of the times (6 years out of 10), Nifty was able to beat fixed income by a big margin because we had 4 good year for the stock market–2010, 2012, 2014 and 2017. We will get years like these in the future as well, which will make up for the losses / underperformance and generate good returns for you in the long term.

So if you have invested in equity mutual funds and have long investment horizon, you should not panic even your investments underperforms for a couple of years – remain invested.

Which is the best time to invest – Practical difficulty

Buy low and sell high is the age old wisdom in stock market. If we applied this wisdom to the Nifty in the last 10 years then 2011, 2015 and 2016 would have provided the best investment opportunities; during this period Nifty fell by more than 20%. If you invested at or around the lowest points of the market in 2011 and 2016, you could have got 16% – 19% CAGR returns in the next three years.

However, applying this wisdom in your investment strategy is easier said than done. When the market corrects 10 – 15%, there is widespread negativity and pessimism all around. Usually you will have bad news coming from different quarters and you fear that more correction is coming. Therefore, you tend to wait unless you are sure that the prices have bottomed out. In my 20 years of experience, I have observed that by the time investors feel confident, the opportunity to buy low is usually long gone.

Difficulty in market timing

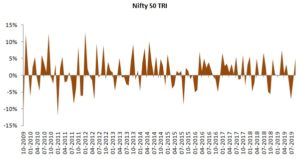

Let us understand why it is difficult to time the market a bit more by looking at monthly returns of Nifty 50 TRI over the last 10 years (see the chart below). You will see in the chart below that, while we may see 2 – 3 consecutive down market months, it is very rare to have 5 – 6 consecutive down market months which can provide a degree of comfort to investors that they will be buying low. Corrections are often followed by pullback rallies and then by profit booking which take the market even lower. This makes it very difficult for investors who want to time the market.

The analysis of monthly returns of Nifty 50 TRI led to very interesting observations:-

Out of the last 120 months (10 years), we had only 66 months (55%) when Nifty 50 TRI gave positive returns

- Nifty 50 TRI gave negative returns in 54 months out of 120 (45%)

- Nifty 50 TRI saw deep monthly correction(falling more than 5% in a month), 11 times in the last 10 years

- Nifty 50 TRI saw a big monthly up move (rallying more than 5%), 23 times in the last 10 years

What can we learn from this?

We can learn several important lessons from the 10 year monthly returns analysis of Nifty. A simple conclusion from the analysis we presented above is that, in order to make money in the market over the last 10 years, you had to remain invested through the 66 months when Nifty gave positive returns. The difficult part evident from the monthly returns chart and the observations summarized (45% down months) in the previous section is that, you need to endure the bad months (when you get negative returns) in order to enjoy the good months which create wealth for you.

Another important observation from the above analysis is that, the 23 months which gave superlative returns (more than 5%) are spread out uniformly across the 10 year period. It is not possible for you to pick and choose these months for investments. You need to have a long investment horizon, so that you can capitalize on both big and small market moves, and create wealth through the power of compounding. We have stated a number of times in our blog that investment horizon / tenure is a far more important attribution factor in wealth creation compared to market timing.

How should you invest?

We have discussed that you need to have long investment tenures to create wealth. You can boost your returns by investing in periods / months when the market is down because you will be buying low. Let us assume that you invested Rs 10,000 at the end of every month / beginning of next month when Nifty 50 TRI corrected by more than 1% from 1st October 2009 to 1st October 2019. Many investment experts describe this strategy as buying on dips. The chart below shows the returns of this investment strategy.

With this buying on dips investment strategy you could have accumulated a corpus of Rs 8.1 lakhs with a cumulative investment of Rs 4.4 lakhs. The XIRR of this investment strategy is 11.3%, which beats the Nifty 50 TRI 10 year CAGR returns (10%). Though the investment principle in this strategy is very simple and the returns are good, this strategy is not easy to execute from a practical standpoint for average retail investors. This strategy requires you to monitor market on a regular basis and make frequent transactions (paper based or online) which take time and effort. End of month or beginning of next month, when these transactions are to be made as per this strategy, are busy periods in the regular jobs of many salaried retail investors.

A much simpler investment plan, which is equally effective (actually better) is our good old mutual fund Systematic Investment Plan, abbreviated as SIP. The chart below shows the returns of Rs 10,000 monthly SIP in Nifty 50 TRI over the last 10 years (ending 1st October 2019). Though this SIP you could have accumulated Rs 21 lakhs with a cumulative investment of slightly over Rs 12 lakhs. The annualized SIP return was 10.7%.

Why is SIP effective?

Let us explain why SIP is more effective than buying on dips. Firstly, SIP is much simpler to execute; with a one-time SIP registration process, you can have fixed amounts debited every month from your savings bank account and invested in a mutual fund scheme of your choice. There is no need to monitor the market and make regular transactions, which require time and effort. With SIP you can put your financial planning on auto-pilot mode. Secondly, the difference in 10 year XIRR between SIP and buying on dips is small; a difference of 60 bps.

Last but not the least, the absolute wealth creation potential of SIP is much more. With SIP you accumulated a corpus of Rs 21 lakhs versus Rs 8.3 lakhs with your buying on dips strategy, albeit with much more investments compared to buying on dips (Rs 12.1 lakhs in SIP versus Rs 4.4 lakhs in the other strategy). In order to match absolute SIP returns with your buy on dips strategy, your balance capital should generate more than 10% XIRR. It is practically not possible to get more than 10% annualized returns from bank fixed deposits, recurring deposits, government small savings schemes etc. over a 10 year period. SIP is not only the simplest way but in practical terms, also among the best for retail investors who want to create wealth over long investment tenures.

Summary

Through this post, we have tried to address some fundamental questions about mutual fund investing like should you remain invested, when to invest, how to invest etc. Please note that the intended investor segment for this post is retail, whose primary source of investment is their regular savings from their monthly incomes. If you have lump sum funds from other sources, you can get the best of both worlds by combining SIP and buying on dips, by tactically investing in lump sum during corrections. If you have lump sum funds available but are worried about market volatility, do not keep your funds idle in your savings bank account waiting for market bottom but invest your lump sum money in a liquid fund and then invest in equity through Systematic Transfer Plan (STP) from your liquid fund over 6-12 months or as advised by your financial advisor.

Finally, we would like to draw your attention to the two observations about Nifty monthly returns that we made earlier.

Nifty 50 TRI gave 5% monthly returns 23 times in the last 10 years more than twice the times when it gave -5% monthly returns.

This is the essence of equity investing. Invest systematically and stay invested for long.